Buying funds with

Scalable Capital

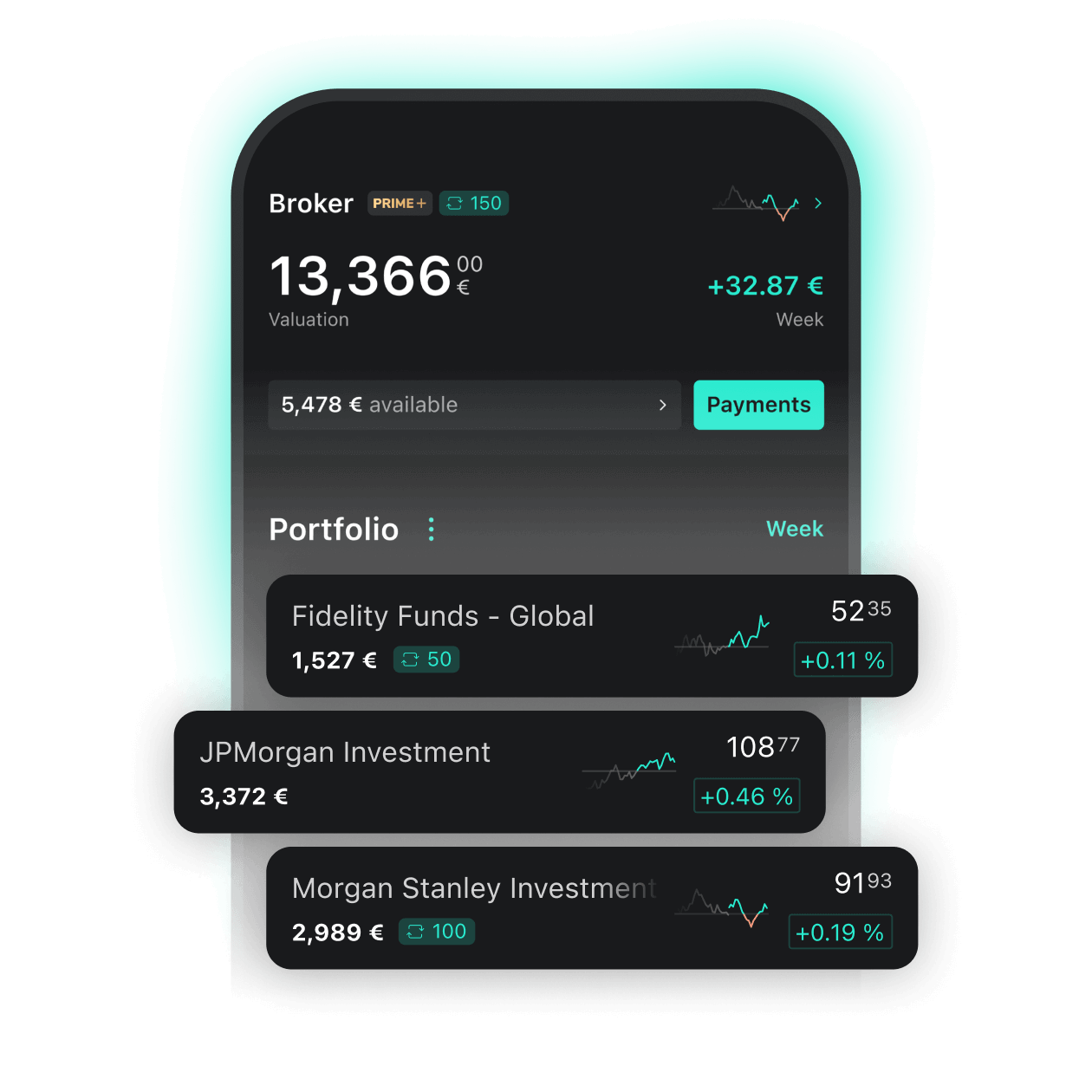

Trade over 3,100 funds - without initial charge.

Investing involves risks.

Trade over 3,100 funds in the Scalable Broker

|

No initial charge |

|

No minimum order volume |

|

Unlimited in the trading flat rate starting from €250 or for only €0.99 per trade* |

*Product costs, spreads and /or inducements may apply.

Popular funds

In the Scalable Broker you have over 3,100 funds at your disposal. The following funds are particularly popular.

*Product costs, spreads and /or inducements may apply.

Investing involves risks.

What are funds?

With a fund, you invest in several securities at the same time - so the investment is often broadly diversified. A fund manager decides the securities that are included. Funds are therefore actively managed and differ from most ETFs (Exchange Traded Funds), which are usually passively managed. Active management, i.e. administration, is paid for by ongoing costs of the fund.

There are different types of funds:

Equity funds

invest primarily in stocks.

Pension funds

contain fixed-interest securities such as government bonds and corporate bonds.

Real estate funds

focus on commercial real estate such as office buildings, shopping centres, logistics and hotel buildings whether domestic or foreign.

Mixed funds

combine different asset classes.

Advantages

Risk distribution: Risk minimisation through investment in several securities | |

Special assets: safeguarding of assets in the event of insolvency of the fund company | |

Active management: Investment decisions by fund managers | |

Availability: Easy and short-term trading on the stock exchange |

Disadvantages

Costs: Reduced returns due to fees for active asset management | |

Risk of loss: Market-related fluctuations in securities | |

Concentration risk: Effects of regional developments in the case of majority investments in certain regions | |

Liquidity risk: Price fluctuations due to unpredictable market situations |

BIT Capital is a Berlin-based investment company specialising in actively managed technology equity funds. The team led by founder and CIO Jan Beckers focuses on the most promising technology sectors and the world's leading companies in these areas. The BIT Global Technology Leaders equity fund is one of the highest-yielding funds in Europe.

Frequently asked questions

You can choose between two models:

FREE Broker:

No order fees1 For trades on the European Investor Exchange and gettex, order fees of €0.99 apply.

PRIME+ Broker:

For just €4.99 per month, you can enjoy unlimited trades on the European Investor Exchange and gettex without order fees1 for transactions over €250, plus savings plans starting at €1 on stocks, ETFs, and other exchange-traded products (ETPs). Trades under €250 on European Investor Exchange cost only €0.99."

Xetra trades:

For order execution via gettex or Xetra stock exchanges, an order fee of €3.99 per trade applies to all clients, along with a trading venue fee of 0.01% of the order volume (with a minimum of €1.50), regardless of the pricing model. This fee covers all third-party trading and settlement costs. Partial executions are charged only once.

There are no additional costs such as securities account fees, flat-rate third-party fees, or issue surcharges. Find a cost overview here.

1Product costs, spreads, inducements and crypto fees may apply.

Learn more.

In the Scalable Broker, you can trade more than 3,100 funds.

Orders can be placed on European Investor Exchange, gettex or Xetra.

The European Investor Exchange electronic trading system is operated by Scalable Capital together with the Hanover Stock Exchange, and generally does not charge brokerage or exchange fees. This applies also to gettex.

For Xetra, an order fee of €3.99 per trade applies to all clients, including those using the PRIME+ Broker. Additionally, a trading venue fee of 0.01% of the executed volume (with a minimum of €1.50) is charged. This fee covers all third-party costs for trading and settlement.

An overview of all costs can be found here.

Trading orders can only be accepted via the client area on the web or in the apps. Telephone orders in particular are expressly not possible. Select the desired fund in the client area. Use the "Buy" or "Sell" buttons to start the order process. The sell option is only available if you already hold shares in the security.

You can set up savings plans for funds from €1 in the Scalable Broker.

We are constantly reviewing whether a savings plan function can be set up for new securities in order to constantly expand our offering.