WEALTHSELECT

Climate-friendly investment

Support climate goals by investing in a global ETF portfolio that is in line with the Paris Climate Agreement.

When investing, your capital is at risk. Learn more about risk here.

Climate strategy

Investing money while taking climate into account? With the climate strategy, this is possible.

You invest in companies around the world that want to reduce their carbon emissions based on the goals of the Paris Climate Agreement in order to drive the change to climate neutrality.

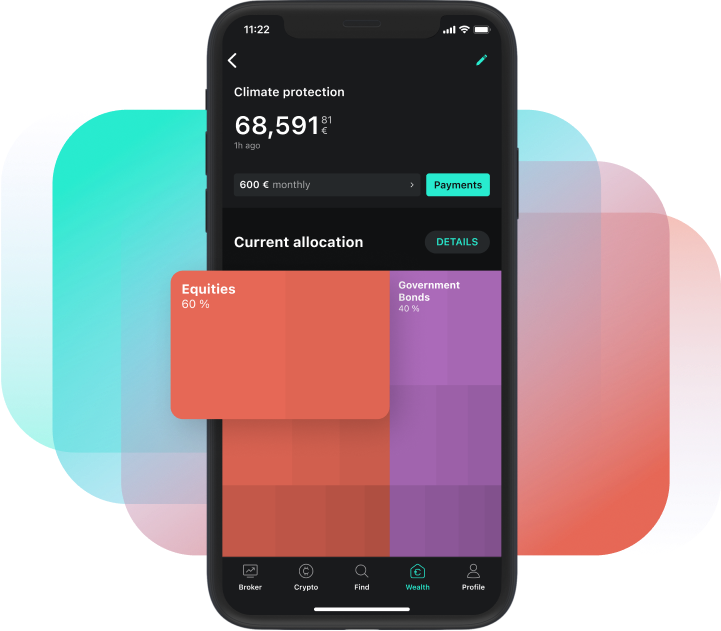

Portfolio allocation

Your portfolio will range from 60% to 100% depending on your individually selected equity quota. Thus, the range

extends from portfolios populated with corporate and government bonds to pure equity investments.

Performance at a glance

Note: Past performance is not a reliable indicator of future performance.

Current investment universe

Asset class | Financial Product |

|---|---|

Stocks / US | Amundi S&P 500 Climate Paris Aligned UCITS ETF |

Stocks / Europe | iShares MSCI Europe Paris-Aligned Climate UCITS ETF |

Stocks / Japan | Invesco MSCI Japan ESG Climate Paris Aligned UCITS ETF |

Stocks / Asia Pacific | L&G Asia Pacific ex Japan ESG Exclusions Paris Aligned UCITS ETF |

Stocks / Emerging Markets | Invesco MSCI Emerging Markets ESG Climate Paris Aligned UCITS ETF |

Stocks / Global | L&G Clean Energy UCITS ETF |

Govt Bond / Global | Amundi Global Aggregate Green Bond UCITS ETF EUR Hedged |

What are Paris Aligned ETFs and how

do they differ from SRI ETFs?

The underlying index for ETFs with the addition "Paris Aligned" is a climate index that is oriented towards the goals of the Paris Climate Agreement. The focus here is therefore particularly on the topic of decarbonisation and, in contrast to SRI indices, does not include social aspects or criteria of ethical corporate governance.

The costs at a glance

Let us manage your assets. Transparent and inexpensive. Learn more about our costs.

Calculate your costs

Portfolio value

€20Total costs per year

Administration & trading

ETF costs (TER)

Total

When calculating the total annual costs, the individual fee levels are taken into account.

Status of product costs: December 2024