Value & Dividend investment strategy

Value & Dividend:

Automated value investing

Invest simply and automatically with ETFs

like star investor Warren Buffett.

When investing, your capital is at risk. Learn more about risk here.

Is the Value & Dividend portfolio a fit for me?

The Value & Dividend portfolio might be of interest to you if you:

Want to benefit from the rise of fundamentally undervalued stocks | |

Are looking for stable sources of income through high-dividend stocks | |

Want to build and grow assets in the medium to long term |

Investing involves risks.

Do you want to discover more? Our further strategies offer different investment focuses.

How the Value & Dividend portfolio works

Benefit from the potential returns of undervalued and high-dividend stocks.

Value investing is an investment strategy that was strongly influenced by star investor Warren Buffett and Benjamin Graham's book The Intelligent Investor. You can easily implement it with our Value & Dividend Portfolio. It is a 100% equity portfolio with global stocks that areundervalued in relation to their fundamentals, i.e. inexpensive. You will also benefit from distributions from high-dividend stocks.

The aim is to benefit from price increases of undervalued stocks as well as dividends and to realise solid returns. To do so, we use globally diversified ETFs from over 1,250 individual stocks.

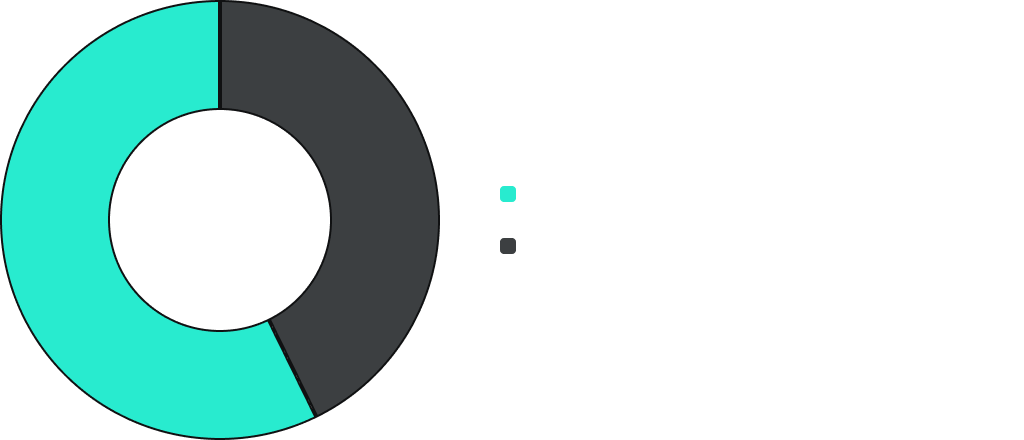

Portfolio allocation

The Value & Dividend strategy invests solely in stocks (100% equity allocation).

Accordingly, both the return potential and risk are increased.

The Value & Dividend portfolio in detail

Value and distribution-oriented investing: how does it work?

Value stocks

... are stocks of companies which, after thorough analysis, are considered to be economically strong but undervalued. The companies tend to have defensive characteristics: they operate in established and often less volatile sectors such as utilities, healthcare or financial services. Thanks to their often solid fundamentals, they can offer an additional margin of safety. This is assessed on the basis of various factors, such as:

Financial health of the company | |

Competitive position | |

Market trends & economic conditions |

For example, a company may have strong profits and a solid cash flow, which in turn is not fully reflected in the share price.

Key figures such as the price-to-book ratio (P/B ratio) and the price-to-earnings ratio (P/E ratio) are used for this valuation. If the P/B or P/E ratio is low, this could indicate that the stock is undervalued. Another important indicator is the fair value of a stock, which represents its "true" value based on its fundamentals. Value investors look for stocks whose current price is below their fair value in order to achieve a margin of safety - this is the difference between the current price of a stock and its calculated fair value.

The idea behind buying such shares is that the market will eventually recognise the true or intrinsic value of these companies, leading to an increase in the stock price.

Dividend stocks

... are stocks of companies that distribute part of their profits to their shareholders in the form of dividends. This can include dividend aristocrats, i.e. companies that have continuously increased their dividends over a period of at least 25 years. These companies often have a stable and predictable business model that enables them to regularly generate profits and pass these on to their shareholders. These are often stocks of quality companies with a high dividend yield. Dividends can help to generate a steady income without having to sell shares.

However, not only the dividend yield is considered, but also other quality characteristics such as:

Cash flow margin | |

Return on invested capital | |

Stability of the free cash flow |

Additional quality screenings may be used. For example, a condition for inclusion in the relevant ETF may be that dividends have been paid consistently over the last five years. Stocks with deteriorating fundamentals in the last 12 months, which could lead to dividends having to be cut or reduced, are also excluded.

Performance at a glance

Note: Past performance is not a reliable indicator of future performance.

Current investment universe

Asset class | Financial Product | Weight |

|---|---|---|

Equity / Value / US | iShares Edge MSCI USA Value Factor (Acc) | 19.0% |

Equity / Dividend / US | Fidelity US Quality Income (Acc) | 28.5% |

Equity / Value / Europe | Xtrackers MSCI Europe Value (Acc) | 11.25% |

Equity / Dividend / Europe | Amundi MSCI Europe High Dividend Factor (Acc) | 11.25% |

Equity / Value & Dividend / Japan | Amundi MSCI Europe High Dividend Factor (Acc) | 12.5% |

Equity / Dividend / Pacific | iShares Dow Jones Asia Pacific Select Dividend 50 (Dist) | 5,0 % |

Equity / Value / Emerging markets | iShares Edge MSCI Emerging Markets Value Factor (Acc) | 6.25% |

Equity / Dividend / Emerging markets | iShares Emerging Markets Dividend (Dist) | 6.25% |

| |

SecurityThe ETFs used in the portfolio are special assets and are protected against insolvency (e.g. by the custodian bank or Scalable) to an unlimited extent. InterestInvest is therefore also suitable for larger investment amounts. |

|

CostsThe Value & Dividend portfolio incurs ETF costs of 0.28 percent per year as well as ongoing costs for portfolio management and trading of 0.49 to 0.75 per cent per year, depending on the investment amount. Learn more. |