Is your portfolio well-constructed or are certain areas overexposed, while others are underrepresented? For a healthy portfolio, good diversification is key. This is often not visible at first sight.

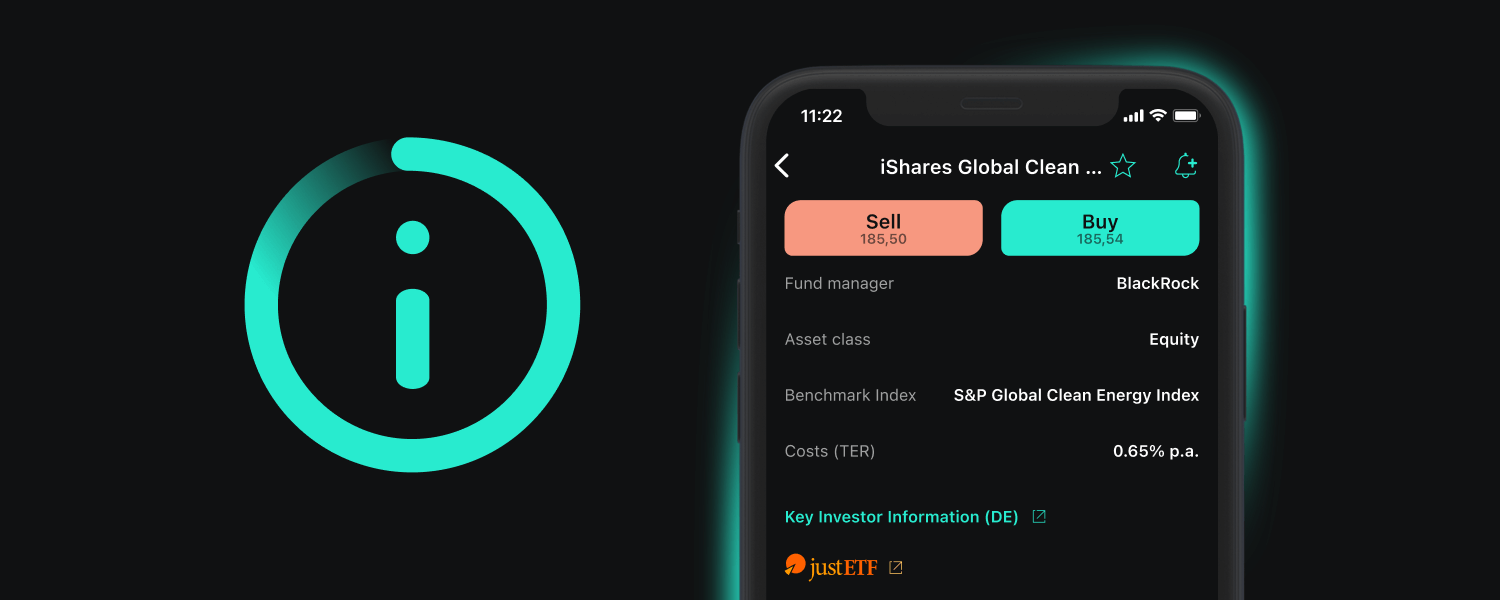

However, you can now use Insights, the extensive portfolio analytics tool in the Scalable Broker to answer exactly these questions. For the analysis of the portfolios and the complex calculation of simulations and stress tests, Scalable Capital harnesses the power of BlackRock’s portfolio analytics. On the web, you can access it through your home screen via the tab Insights. In the app, it is accessible via the graphic on the top right.

What does the analysis contain?

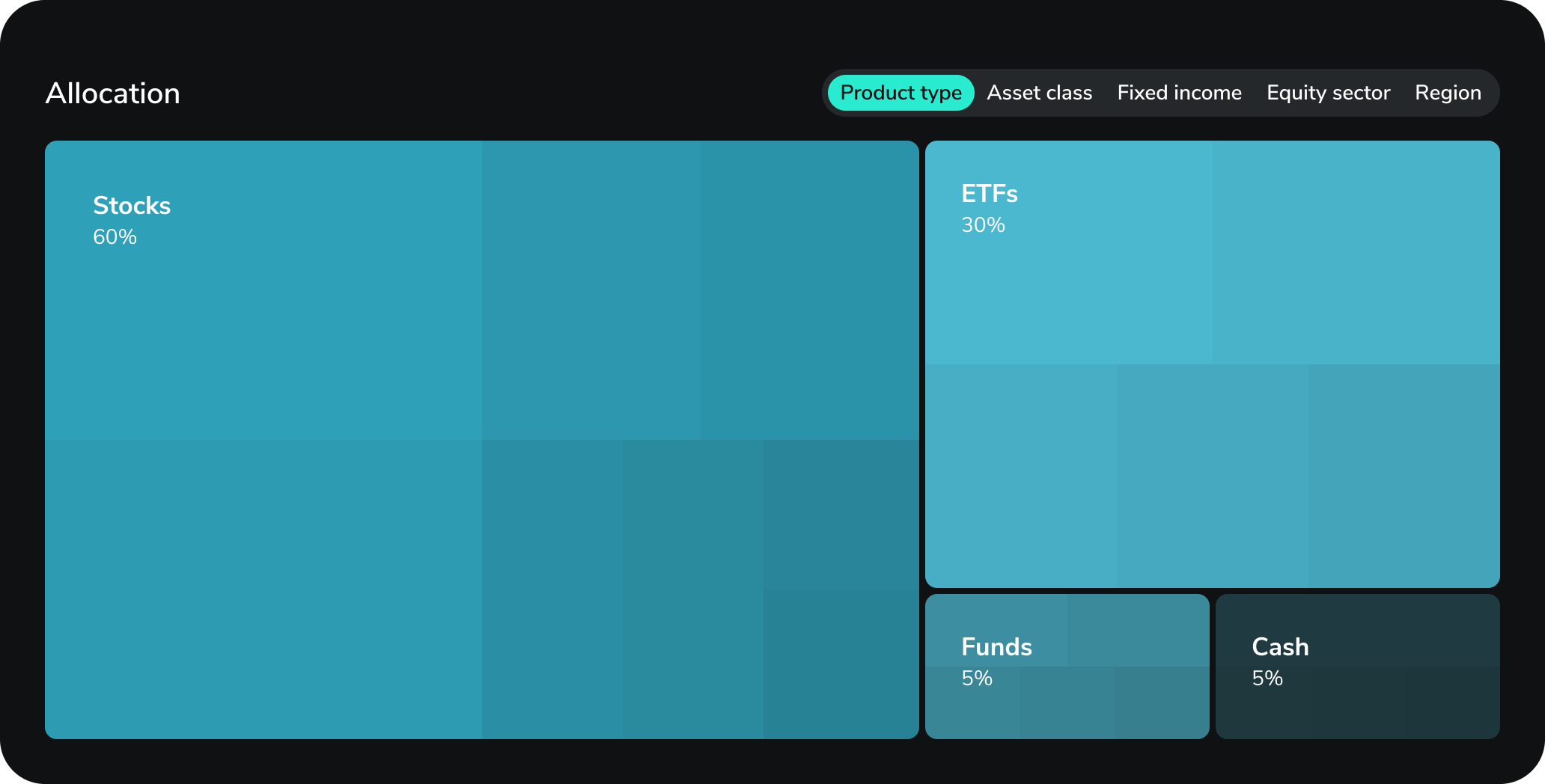

In all broker price models a breakdown of the portfolio by investment instrument or product type is shown, i.e. by stocks, ETFs, funds and cash.

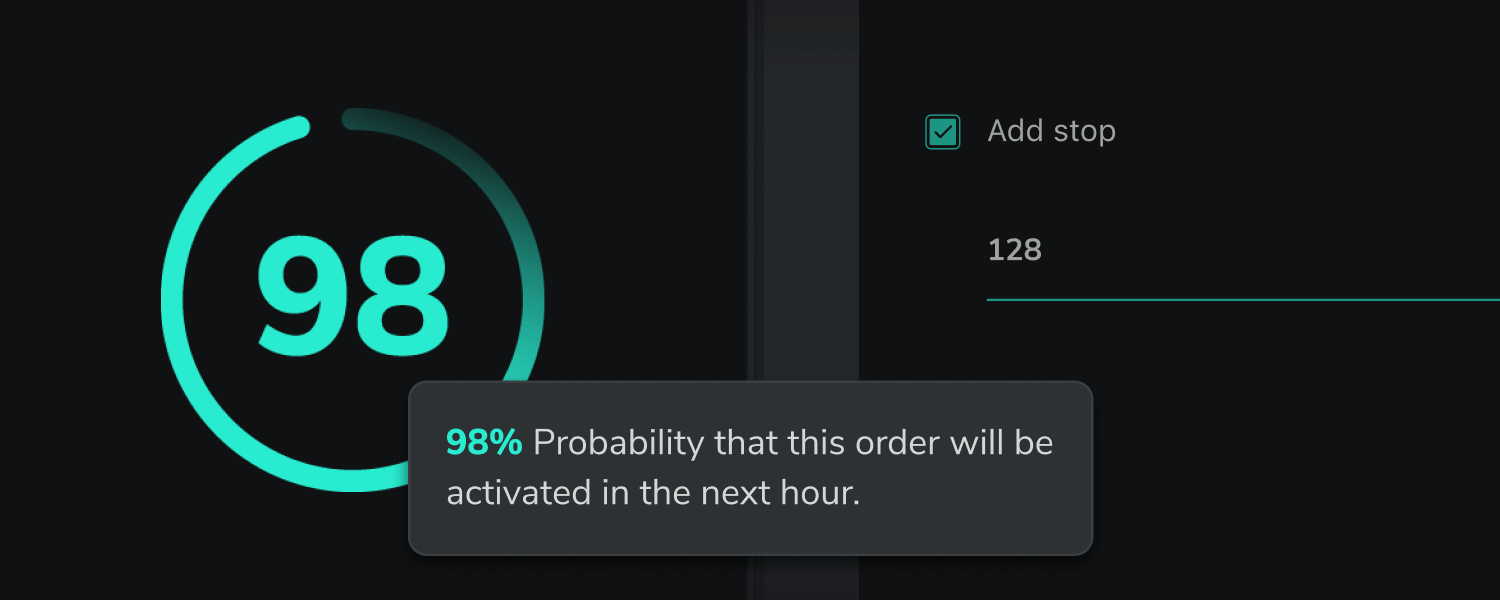

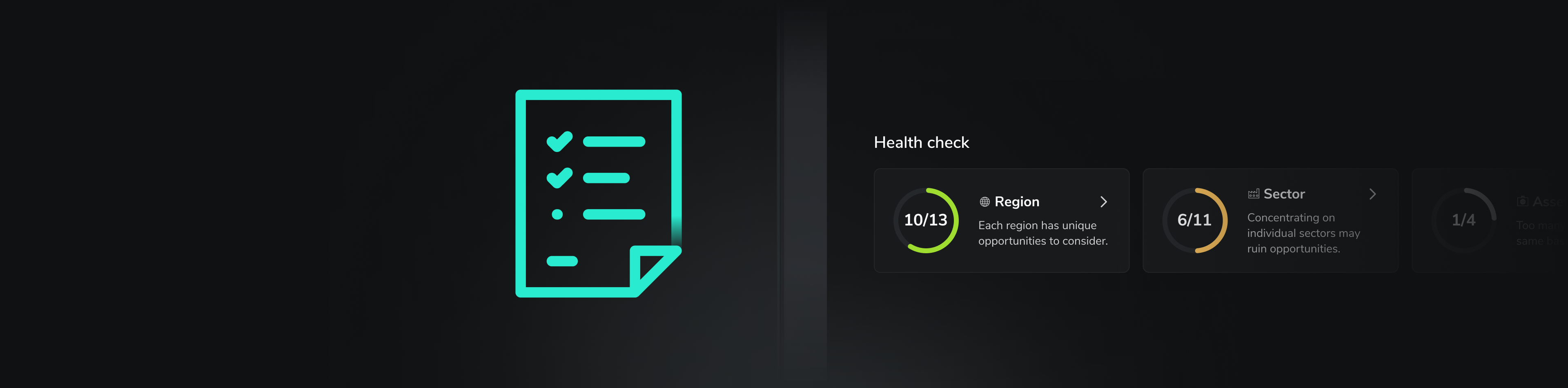

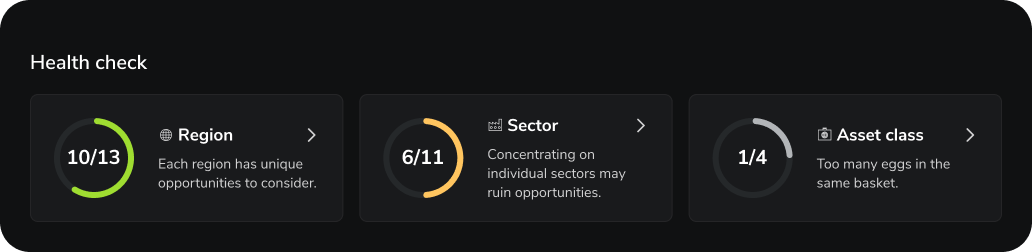

The portfolio health check provides an excellent overview and identifies areas with the need for action. It evaluates the portfolio diversification in regards to regions, sectors and asset classes as well as pointing out missing areas, which could be tackled to optimise the portfolio .

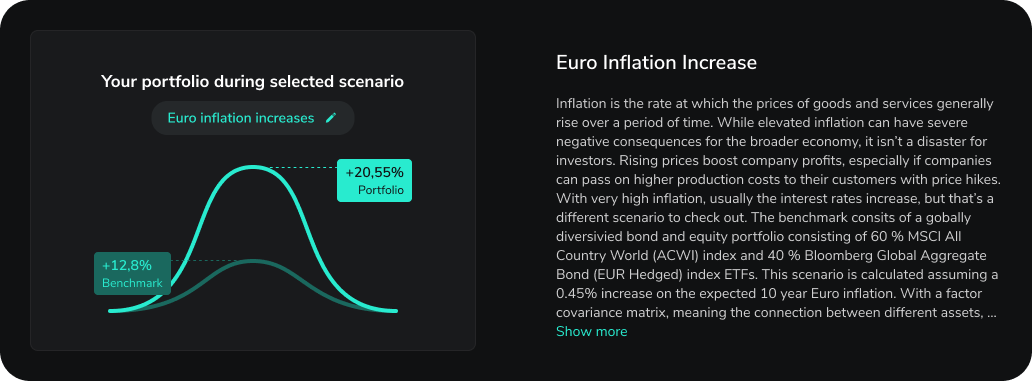

Additionally, hypothetical scenarios such as increased inflation or a price decline of European stocks can be run to see its impact on your portfolio.

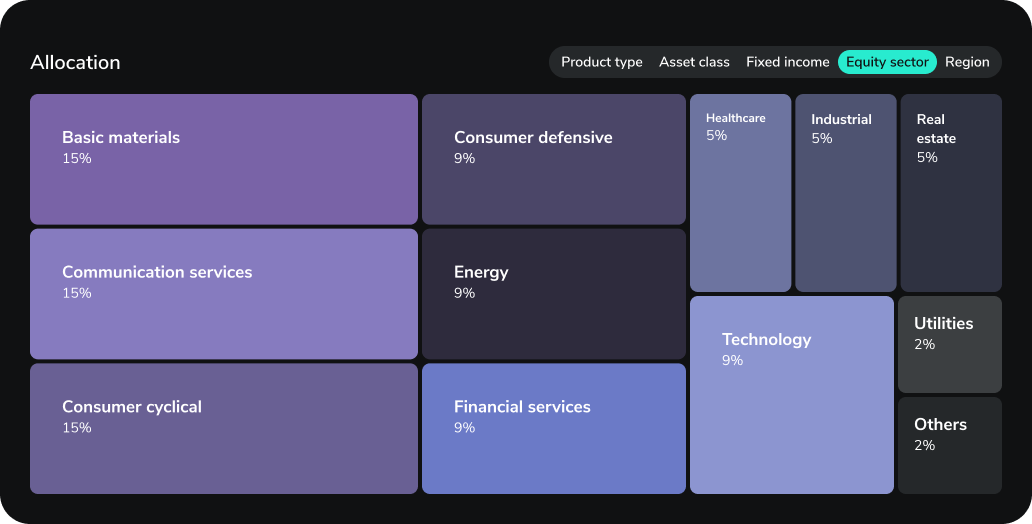

With PRIME and PRIME+, you also have access to deeper analyses. Among those are a detailed distribution of the portfolio by sectors, regions and other categories. In the FREE Broker, these functions can be tested once for 8 hours.

Allocation

Here you can see a distribution by product type, asset class, fixed income type, equity sector and region.

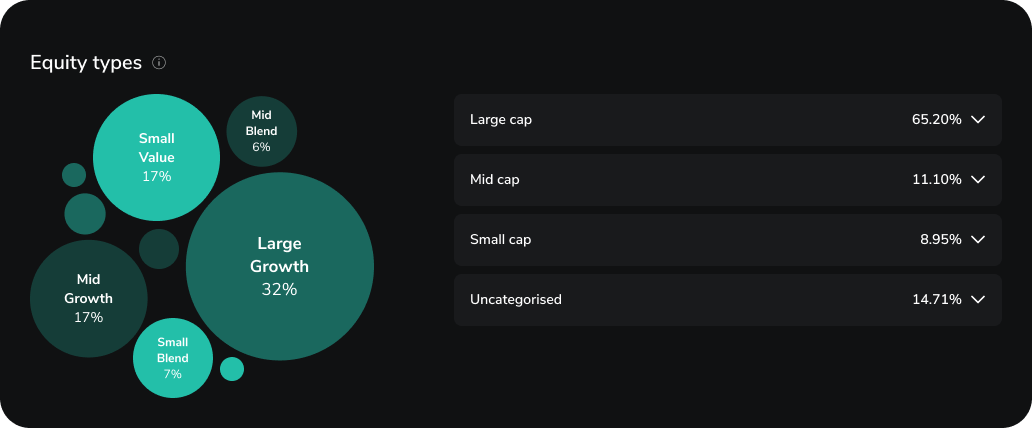

Equity types

This distribution represents a breakdown of securities by equity type. They are categorised by size (small, mid and large caps) and type (value, growth and blend).

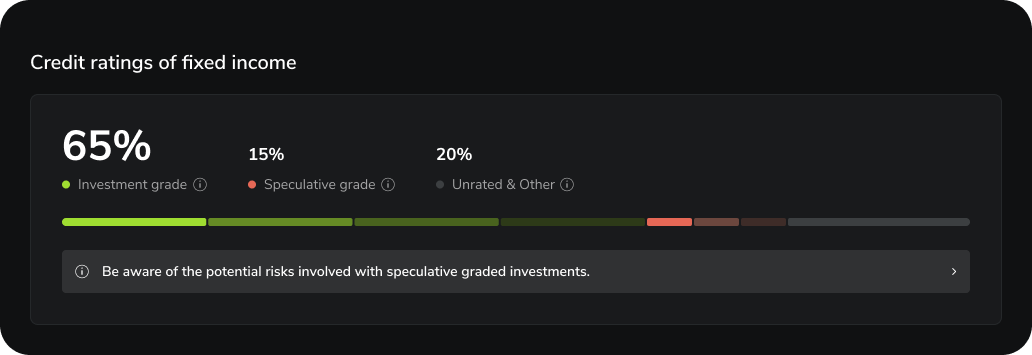

Credit ratings of fixed income

Here, the credit ratings of your fixed income exposures are listed. This includes single bonds as well as all other products containing bonds, such as funds and ETFs.

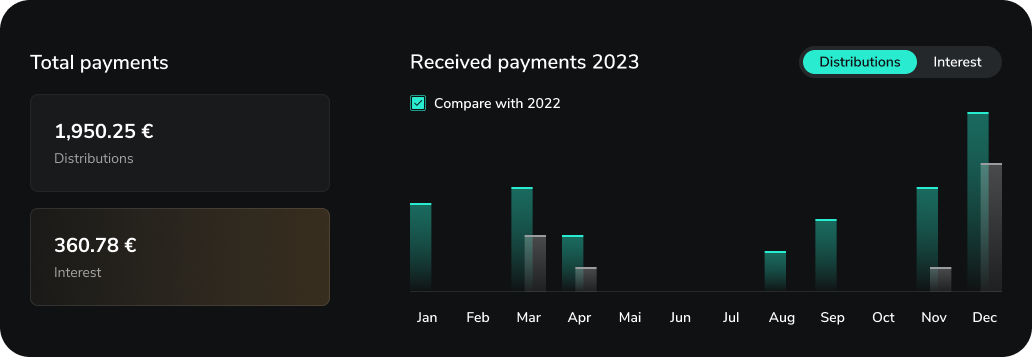

Total payments

Within the section Total Payments, you can view the amount of all distributions such as dividends as well as for PRIME+ interest at one glance.

Upgrade now to PRIME or PRIME+ to step up your portfolio analytics with Insights.

Note: BlackRock's Portfolio 360 technology powers certain data for the portfolio analytics presented by Scalable. The analytics and services offered are provided to you by Scalable. BlackRock does not provide any service or product to you, nor has BlackRock considered the suitability of this information against your individual needs, objectives, and risk tolerance and accepts no liability in connection therewith.

Risk Disclaimer – There are risks associated with investing. The value of your investment may fall or rise. Losses of the capital invested may occur. Past performance, simulations or forecasts are not a reliable indicator of future performance. We do not provide investment, legal and/or tax advice. Should this website contain information on the capital market, financial instruments and/or other topics relevant to investment, this information is intended solely as a general explanation of the investment services provided by companies in our group. Please also read our risk information and terms of use.