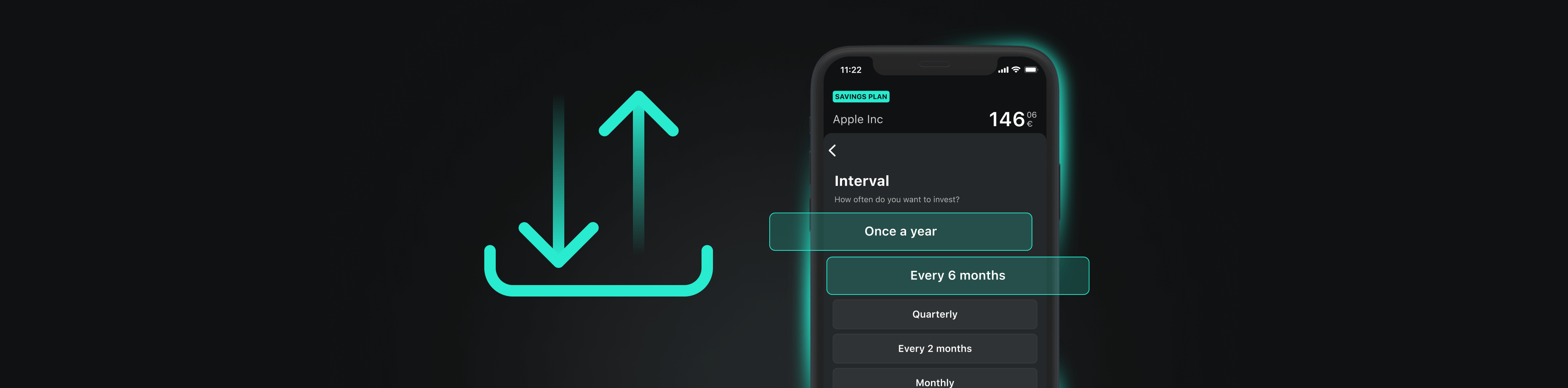

In addition to monthly, bi-monthly and quarterly execution, there are now two more intervals at which you can have your savings plans executed: semi-annually and annually.

In which case is an annual or semi-annual savings plan execution useful?

Generally speaking, the additional savings plan intervals offer you more individual scope for structuring your investment. If you regularly receive money at certain times of the year, for example the annual company bonus or the gift of money at Christmas, you can automatically plan these sums for your asset accumulation.

Risk Disclaimer – There are risks associated with investing. The value of your investment may fall or rise. Losses of the capital invested may occur. Past performance, simulations or forecasts are not a reliable indicator of future performance. We do not provide investment, legal and/or tax advice. Should this website contain information on the capital market, financial instruments and/or other topics relevant to investment, this information is intended solely as a general explanation of the investment services provided by companies in our group. Please also read our risk information and terms of use.