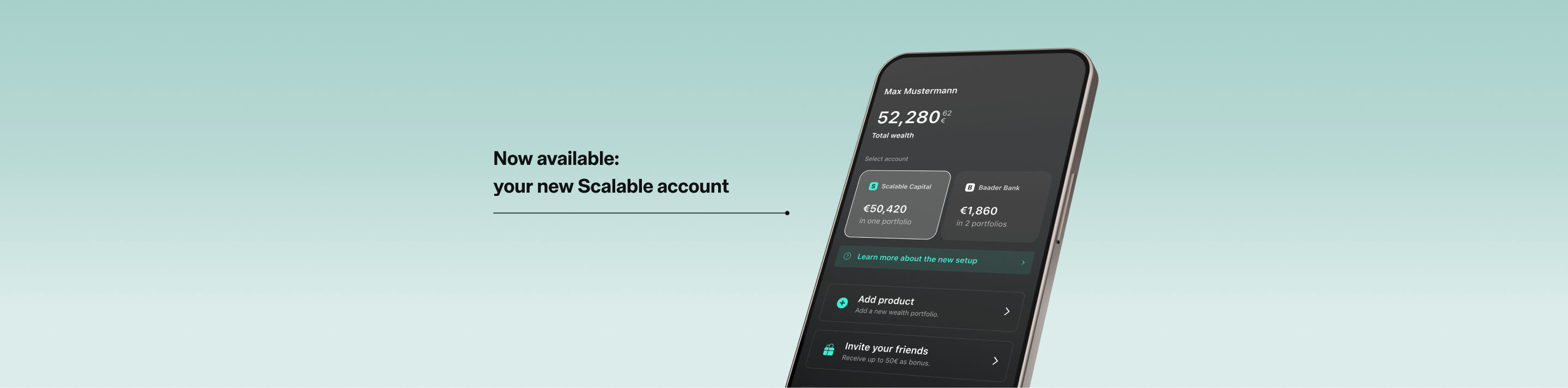

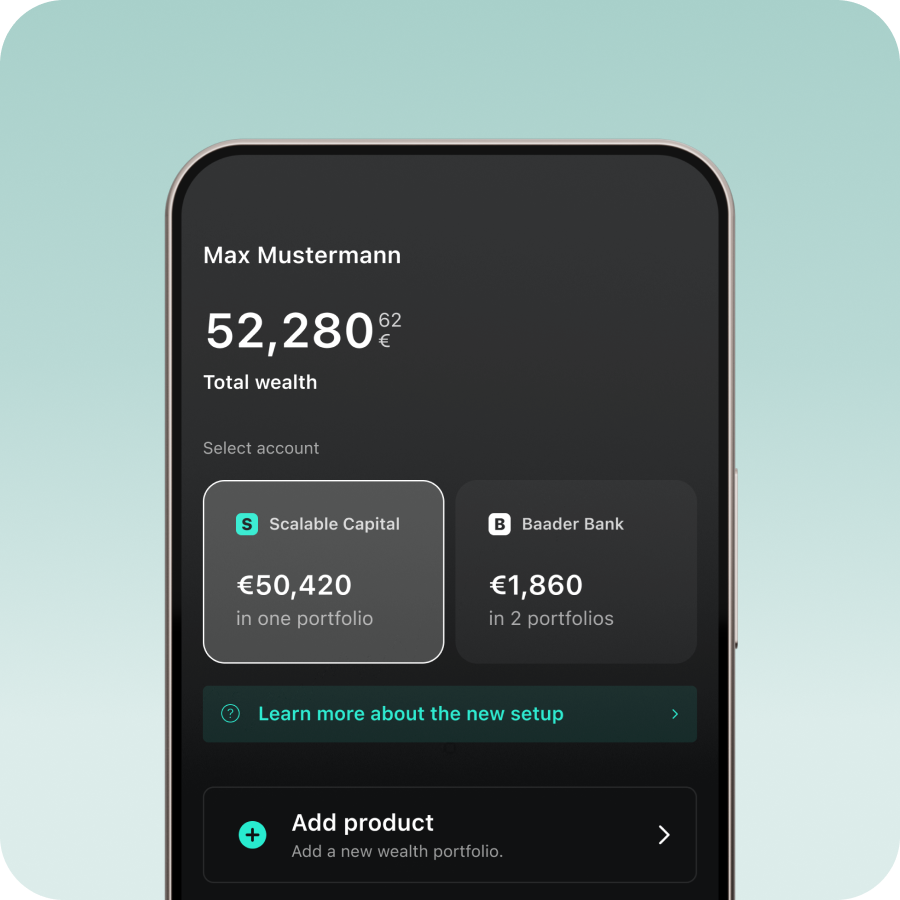

Existing clients are currently gradually receiving the new Scalable account, additionally to their Baader account. This is new in the Scalable account:

- 3% interest p.a.* on up to €500,000 in PRIME+ and €50,000 in FREE forwarded from partner banks and money market funds at Scalable; interest according to special conditions at Baader Bank

- New IBAN for payments at Scalable; your IBAN at Baader Bank remains unchanged

- All securities accounts in the Scalable app; switch via Profile

- No additional costs, regular PRIME+ fee will be charged from your account at Scalable (primarily, dependent on cash balance) or Baader Bank

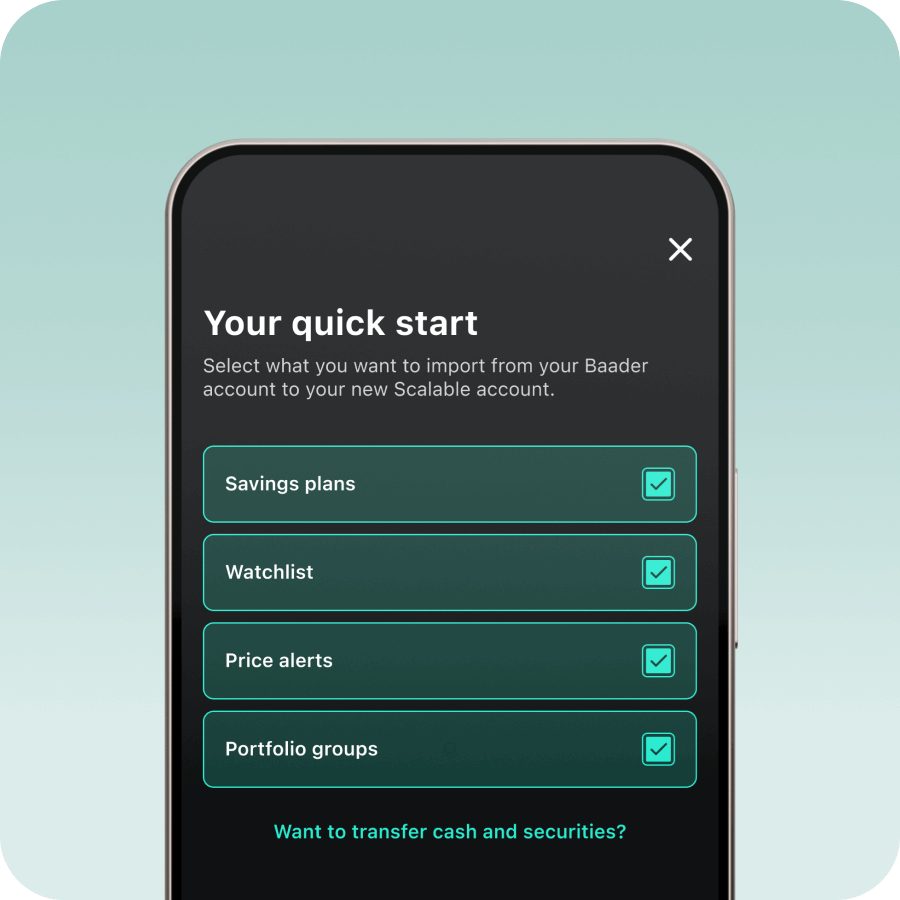

- Quick Start: Automatically import your Savings Plans, Price Alerts, Portfolio Groups and Watchlist to your Scalable account

Do I receive the same interest rate in both accounts?

In your new Scalable account we forward 3% interest p.a.* on up to €500,000 in PRIME+ and €50,000 in FREE from partner banks and money market funds. The current rates can be found here.

For cash in your Baader Bank account interest rates according to special conditions at Baader Bank apply.

How can I deposit cash into the new Scalable account?

You can easily instruct deposits and withdrawals in your client area under Payments. Alternatively, you can also transfer from your current account. When making a deposit, please ensure you use your new Scalable IBAN.

How does Scalable distribute cash balances?

We want to pass on attractive interest rates and thus provide a competitive offer. To this end, we distribute the cash balances among trustee banks and qualified money market funds. We take into account our strict selection criteria, the available capacities and conditions on the money market and the trading activity of our clients. This may mean that cash balances are only held at a trustee banks and/or only at a qualified money market fund. All clients with a Scalable account can see how the cash balance is allocated via the account statement and at any time in their client area in the app or on the web.

Please note our risk information on the safekeeping of cash balances.

Why is the forwarded interest variable?

Cash balances are held at trustee banks and money market funds without a fixed term and with variable interest rates. The respective interest rate is based on the conditions on the money and/or capital market and the ECB's interest rate for deposits. The trustee banks may raise or lower their interest rates at any time. The interest rate of the qualified money market funds, also known as the yield, can be viewed on a daily basis at the respective fund provider. You can find all links and the documents of the trustee banks and qualified money market funds here: https://de.scalable.capital/en/documents-information.

Please note our risk information on the safekeeping of cash balances.

How can I transfer cash between my two accounts?

To transfer cash between your Scalable and Baader accounts, first instruct a withdrawal to your current account (reference account) in the Scalable client area of the respective account. You can then deposit the cash to your other account via bank transfer, direct debit, or Scalable Instant.

Starting in the fourth quarter of 2025, as part of the automatic account transfer service, your cash balance from the Baader account will be directly transferred to your Scalable account.

Can I transfer my securities from the Baader account to the new Scalable account?

Please use our account transfer service in the fourth quarter of 2025 for this purpose. Only in this way can we ensure a smooth transfer of your securities with our partner Baader Bank. We will take all necessary measures to facilitate a seamless transition.

Your accounts at Baader (Wealth and Broker) will be transferred including cash, savings plans, fractions, loss pots and exemption order (“Freistellungsauftrag”). After the transfer we will close your account. Your account at Scalable will then contain all your positions as well as your transaction history and documents. We will inform you beforehand.

Securities transfers require manual processing steps at both the sending and receiving institutions, as well as coordination with the clearing houses and other parties involved. Therefore, we will carry out the transfer service for our clients collectively in the fourth quarter of 2025. This is the only way we can plan with sufficient lead time and provide an orderly and trouble-free transition. We will work closely with our partner Baader Bank, the custodians, and all other relevant parties.

Will I receive a new IBAN?

Yes, you will receive a new IBAN for the new Scalable account. You can find it in the app under Profile > Account details (Scalable Capital) > Products. On the website, it can be found under Profile > Products > Product Details.

Your Baader Bank IBAN remains. You can find it under Profile > Account details (Baader Bank) > Products. On the website, it can be found under Profile > Products > Product Details.

How do I gain access to the new Scalable?

Log into your client area. There, you can agree to the new terms and conditions to get access to the new Scalable.

If you already gave your consent, you do not need to take any further action. We will automatically open the new Scalable account for you.

Do I still have access to my Baader account?

Yes. You will still have access to all existing accounts at Baader Bank alongside the Scalable account. Your app and access credentials will remain unchanged. No reidentification is required. In the app, you can easily switch between your existing Baader and your new Scalable securities account in the profile. On the web, this can be done via the side bar navigation.

Where will my PRIME+ or PRIME fee be deducted from in the future?

The regular PRIME+ or PRIME fee will only be charged from one account, depending on the availability of cash in your Scalable and Baader accounts. If cash is insufficient in both accounts your Scalable account will be overdrafted and you will be informed in a message.

Will my Baader account be transferred to Scalable Capital?

Yes, your accounts at Baader (Wealth and Broker) will be transferred including cash, savings plans, fractions, loss pots and exemption order (“Freistellungsauftrag”). After the transfer we will close your account. Your account at Scalable will then contain all your positions as well as your transaction history and documents. We will inform you beforehand.

We will take all necessary measures to facilitate a seamless transition with our partner Baader Bank. You don’t have to take any action. You will be informed before the start of the transfer.

What is the European Investor Exchange?

The European Investor Exchange is Europe's most modern stock exchange, specifically focused on the needs of individual investors. Scalable Capital operates European Investor Exchange in cooperation with the Hanover Stock Exchange. Scalable Capital provides technology and liquidity. The Hanover Stock Exchange is responsible for the oversight according to German public law, particularly for trading supervision.

Is Scalable a bank now?

No. We are an investment firm, which means we can handle your securities account and all investment-related services. For your cash balances, we work with partner banks and money market funds. In addition to managing the securities accounts, we have applied for authorization for deposit business to be able to accept client deposits ourselves in the future.

What happens in case of insolvency of Scalable Capital or the partner banks?

Cash balances are safeguarded in accounts with partner banks and in money market funds. Initially, these are Deutsche Bank, J.P. Morgan Asset Management, DWS, and BlackRock. Deposits are protected up to €100,000 per customer per bank under the statutory deposit protection scheme. For money market funds, European investor protection rules (UCITS) apply regardless of the amount.

I have deposited my non-assessment certificate with Baader Bank. Do I have to resubmit it for the Scalable account?

Yes, the non-assessment certificate must be resubmitted. Tax offices issue non-assessment certificates for a period of up to three years. You can find the application for a non-assessment certificate here.

Once you have received the non-assessment certificate from your tax office, please send it as a scan by e-mail to service@scalable.capital. Please do not send us any original certificates.

What is a money market fund?

For your broker account, we work with partner banks as well as qualifying money market funds. These are closely regulated funds that have to meet the following requirements:

- Adhere to European investor protection rules (UCITS), regardless of the amount you invest

- Their primary aim is to keep the value of the fund stable

- They invest exclusively in high-quality short-term instruments (e.g., treasury bills, commercial papers, or certificates of deposit) with an average maturity of 60 days.

- Provide liquidity through same-day or next-day settlement

- Like all securities, money market funds are segregated assets and therefore would not be part of the insolvency assets of Scalable Capital or the fund issuer

Please be aware of the risks of money market funds.

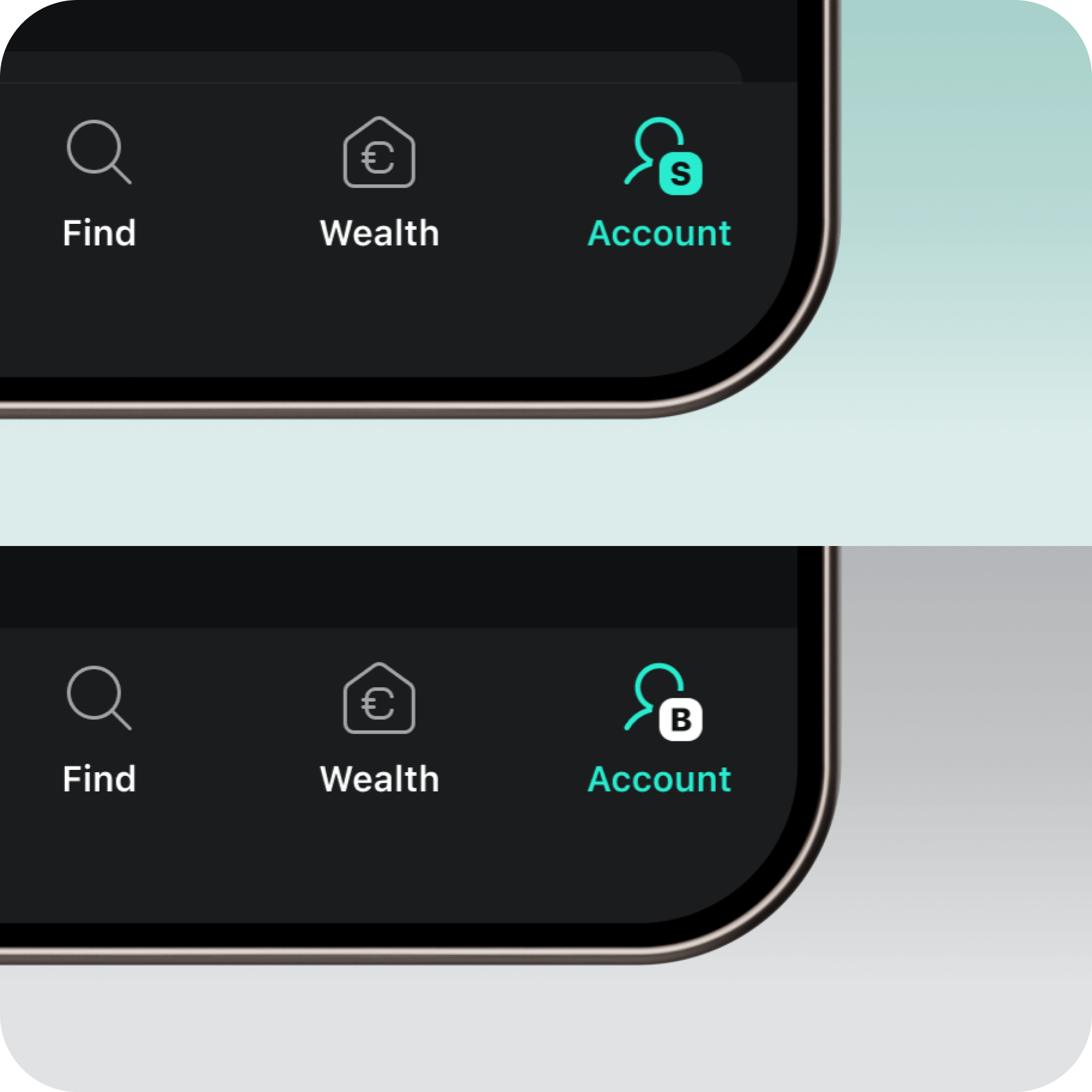

You now have simultaneous access to all your accounts. In the app, you can easily switch between accounts in your profile. On the web, this is possible via the side navigation on the left.

You can identify which account you have selected in the app by the icon on the profile tab: the S-icon for Scalable, the B-icon for Baader Bank.

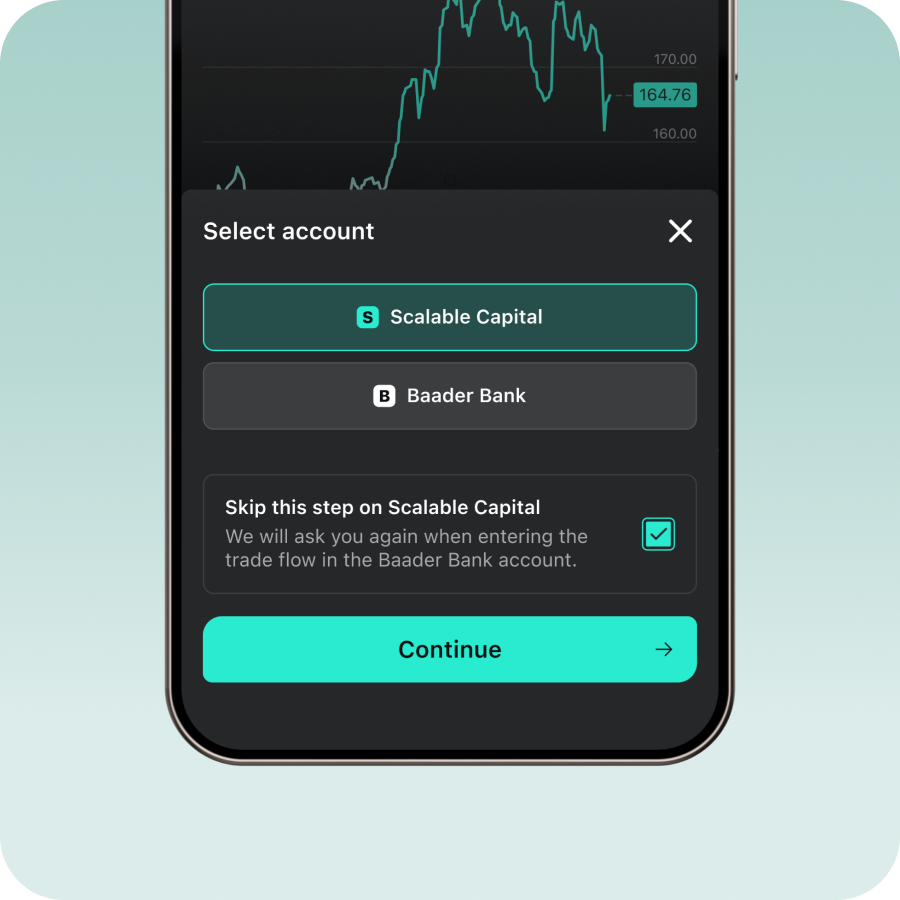

When trading a security, you can check whether the desired account for placing the order is selected.

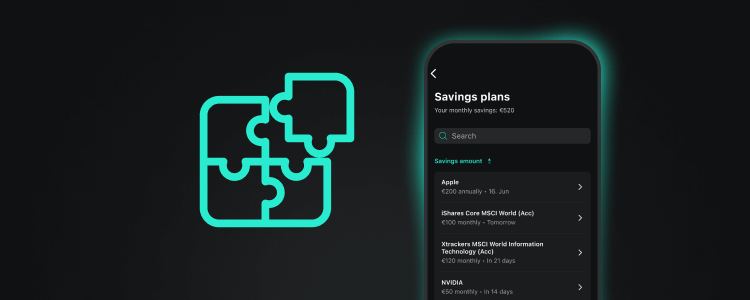

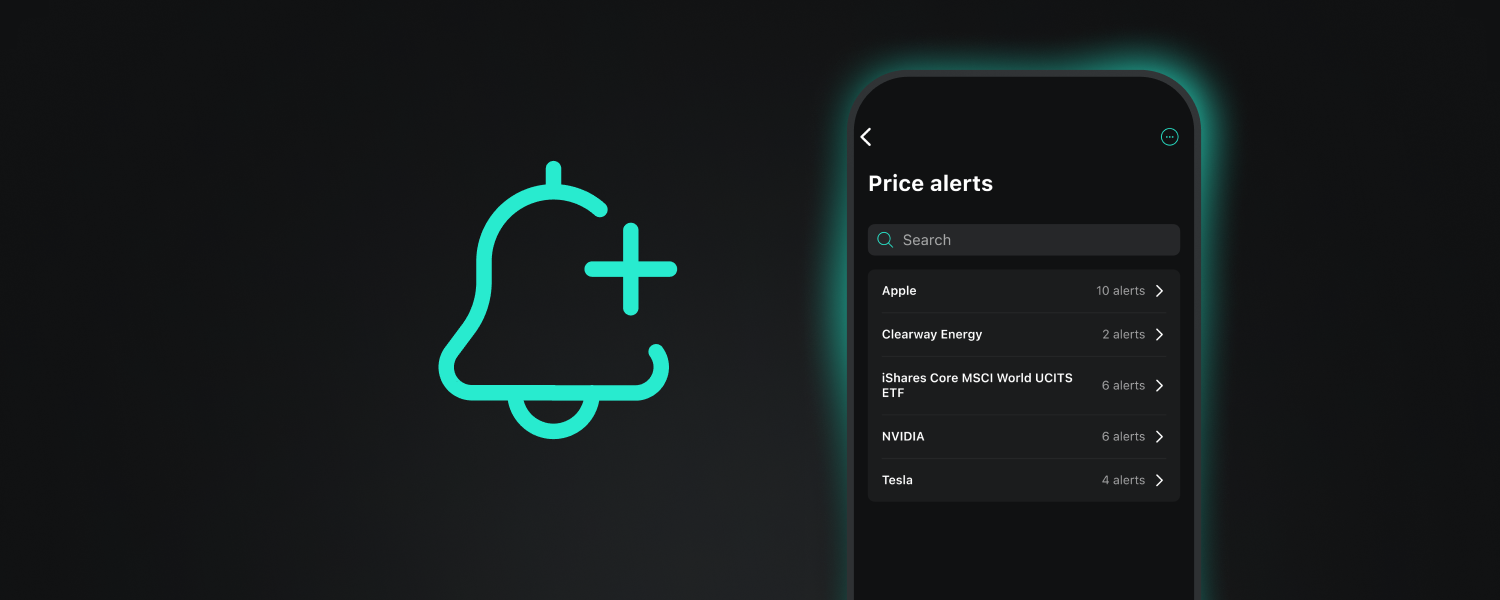

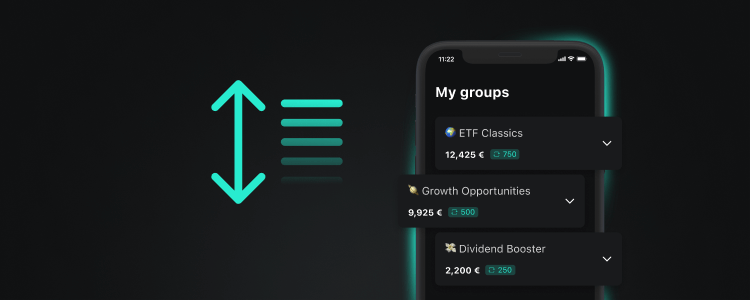

With the Quick Start feature, you can set up your Scalable account with just a few clicks.

Get startedExisting elements and settings from your Baader account will be easily imported into your Scalable account:

- Savings plans

- Price alerts

- Watchlist

- Portfolio groups

Important: No securities will be transferred. Existing securities will only be transferred from Baader Bank to your new Scalable account in the fourth quarter of 2025. We will inform you in advance.

Risk Disclaimer – There are risks associated with investing. The value of your investment may fall or rise. Losses of the capital invested may occur. Past performance, simulations or forecasts are not a reliable indicator of future performance. We do not provide investment, legal and/or tax advice. Should this website contain information on the capital market, financial instruments and/or other topics relevant to investment, this information is intended solely as a general explanation of the investment services provided by companies in our group. Please also read our risk information and terms of use.