Strategy & technology explained

How Scalable Wealth works

Learn more about Scalable Wealth: A look inside digital wealth management.

Investing involves risks.

Our standard

A professional investment service tailored to your financial goals.

At Scalable Wealth, experts look after your money and invest it the way you would like to invest it yourself: with low-cost ETFs, intelligently combined into a continuously monitored ETF portfolio. Providing you a modern and personalised investment without the worry and the hassle.

Building wealth for the long term

With Scalable Wealth, we invest in the capital markets to secure long-term return opportunities.

Invest effortlessly in ETFs

More than just one ETF. Our investment specialists create a carefully curated ETF portfolio based on data.

Individually tailored to you

We offer numerous investment strategies with different focuses and risk profiles to suit you.

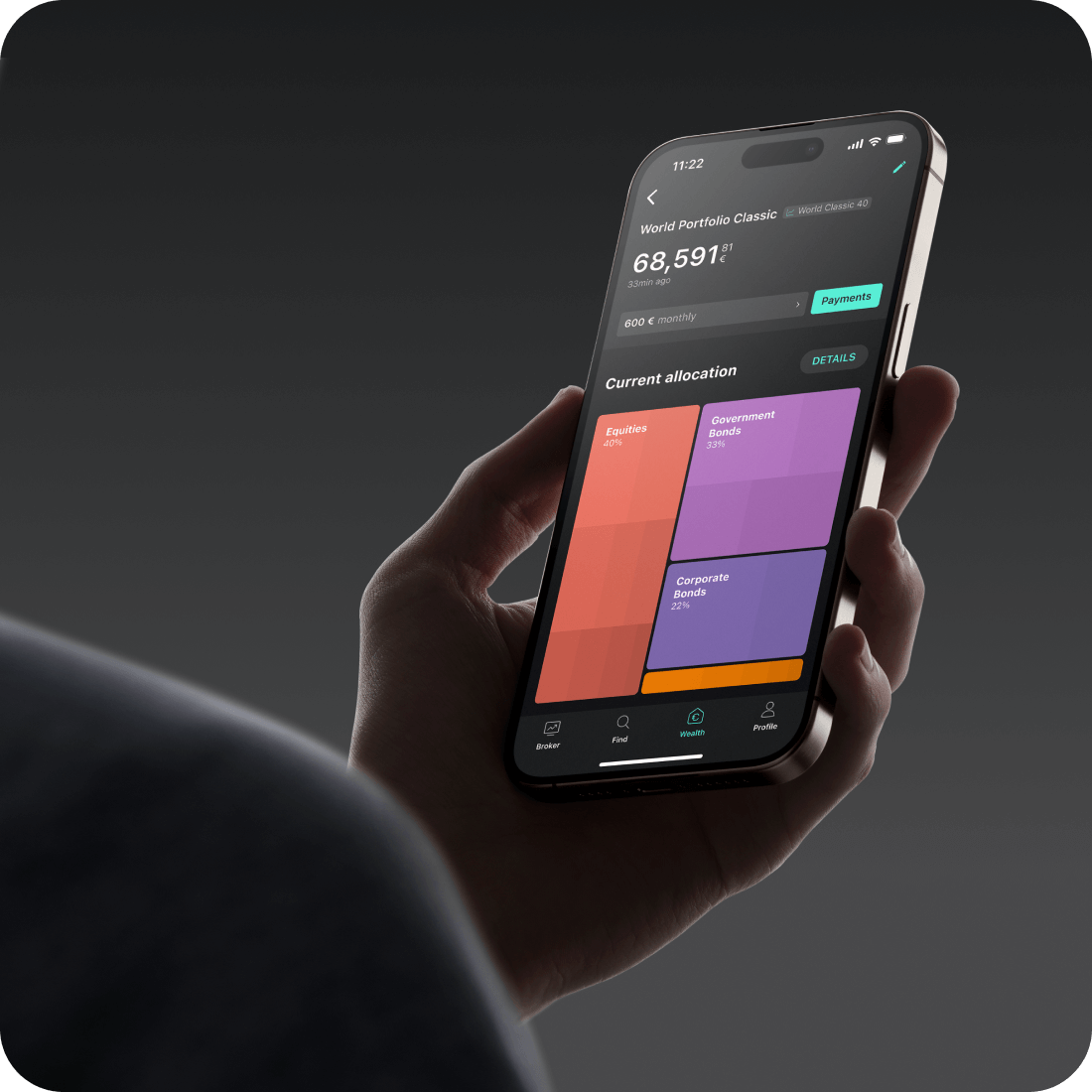

Professionally managed and monitored

Scalable Wealth reviews all portfolios daily and adjusts them if necessary. Rebalancing, trading, tax optimisation, deposits and withdrawals – all included.

Individual, cost-effective and automated

Conveniently achieve more with our ETF portfolios.

As the market-leading robo-advisor in Germany, we invest with broad diversification in low-cost ETFs. This is what makes our digital asset management unique:

Capital market |

|---|

Investment in the capital market

Capitalise on return opportunities and build long-term wealth

|

Scalable takes care of and monitors your investment |

|

Build up long-term wealth effortlessly and hassle-free |

|

Benefit from return opportunities in the capital markets |

Whether it's the children's education, saving for your retirement or a financial cushion for the future - there are many reasons why putting money aside makes sense

for everyone. Most Austrians still rely on cash savings to build their wealth, however, there are more effective ways to grow your savings in the long term.

A simple calculation shows that it takes 35 years to double assets in a regular savings account. In the capital markets, this is possible in just 10 years.1 Your choice of asset classes therefore has a significant influence on your asset growth potential.

This is where long-term thinking pays off. By investing regularly over a longer period of time, compounding has a greater impact, thereby increasing the growth momentum of your assets. For example, as shown in the chart, the price gains on an investment over the last 18 years can account for over 60 per cent of the assets.1

Broadly diversified stock investment with €5,000 deposit and

a savings plan of €250 per month

Source: iShares, own calculations. ETF data based on MSCI World

(ISIN: IE00B0M62Q58) from 31.10.2005-30.11.2023

1Average return of 2% p.a. on overnight money (based on the ECB's inflation target) and 7.7% p.a. through an ETF investment in the global equity market (MSCI World, ISIN: IE00B0M62Q58) over 18 years (31 October 2005-30 November 2023).

Note: Past performance is not a reliable indicator of future performance. Investing involves risks.

ETF-based |

|---|

ETF-based

Simple and cost-effective investing

|

Selection of the best and most cost-effective ETFs from over 3,000 products available |

|

Intelligent composition of the portfolio with up to 15 individual ETFs |

|

Tax-efficient exchange when better ETFs are available |

Stiftung Warentest (one of Germany’s most trusted independent test magazines) and the German consumer advice centres agree: ETFs rank among the best financial products for building wealth via the capital markets.2 They are not only up to 85 percent cheaper than actively managed funds (see chart), but studies also show that ETF-based benchmark indices generally perform better than active funds3.

At Scalable Wealth, our investment professionals construct a portfolio of up to 15 individual ETFs. This combination saves more than 16 per cent in costs compared to an average ETF on the market. The ETFs are selected completely independently and according to a strict multi-stage process in which the products are assessed in terms of composition, diversification, costs, tax efficiency, tracking quality, liquidity and replication method.

ETFs are up to 85% cheaper than actively managed funds

Source: Investment Company Institute as well as own calculations

2 Sources: Stiftung Warentest and the Verbraucherzentralen

3 Sources: Morningstar, justETF

Individual |

|---|

Individual

The right portfolio for anyone with goals

|

ETF portfolios individually tailored to your risk/return profile |

|

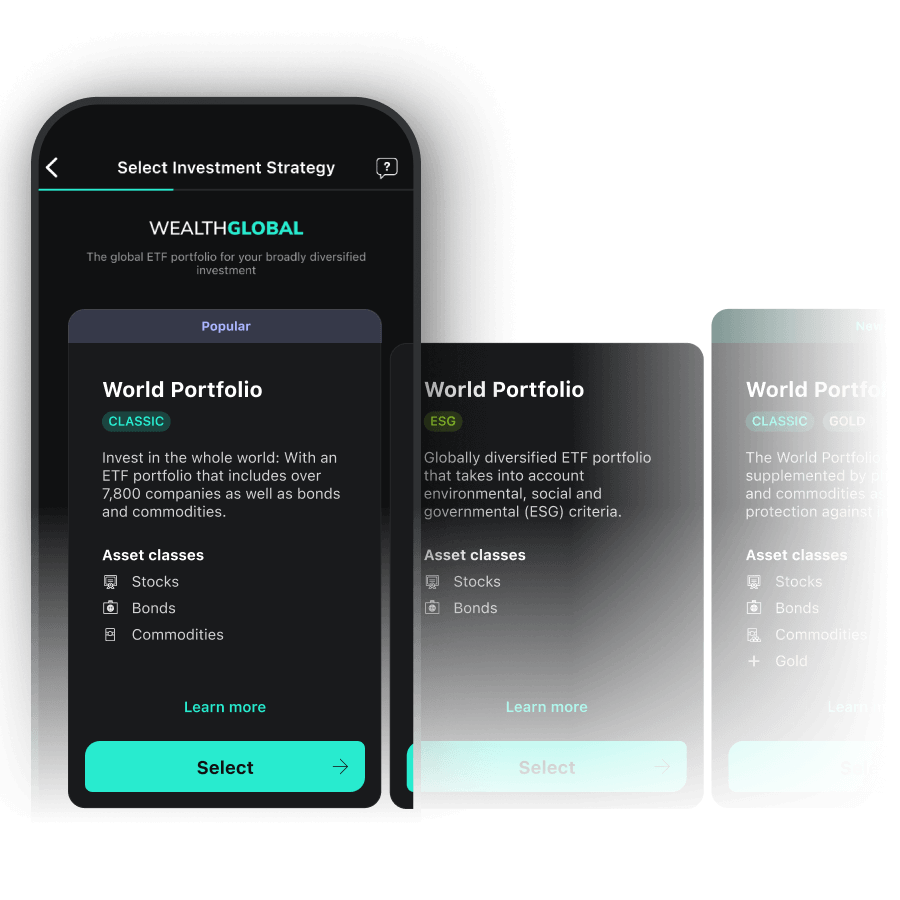

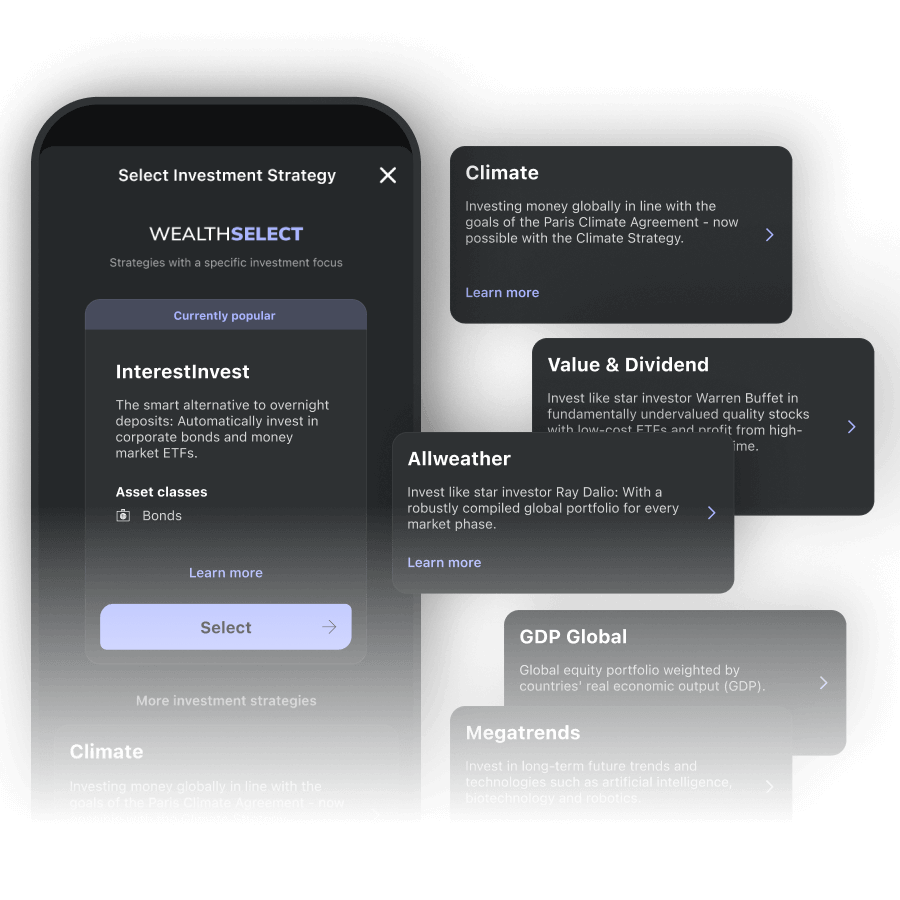

Numerous investment strategies to choose from |

|

Deposit and withdraw money flexibly and adjust savings plans whenever you like |

At Scalable Wealth, we offer personalised investments that suit your values and goals.

We use a digital questionnaire to determine investment goals and risk tolerance and based on this, suggest suitable investment strategies.

You can then sit back and relax while our experts take care of creating your portfolio.

Globally diversified or rather a portfolio with that little bit extra?

We offer strategies for every type of investment: with Wealth Global, you invest in numerous companies around the world as well as bonds and commodities. Alternatively, choose one of our Wealth Select strategies with a specific focus:

From InterestInvest, Megatrends or Allweather – we have the right portfolio for you.

Professional |

|---|

Professionally managed

Expertise and leading technology for investments

|

Daily monitoring of the portfolio during trading days |

|

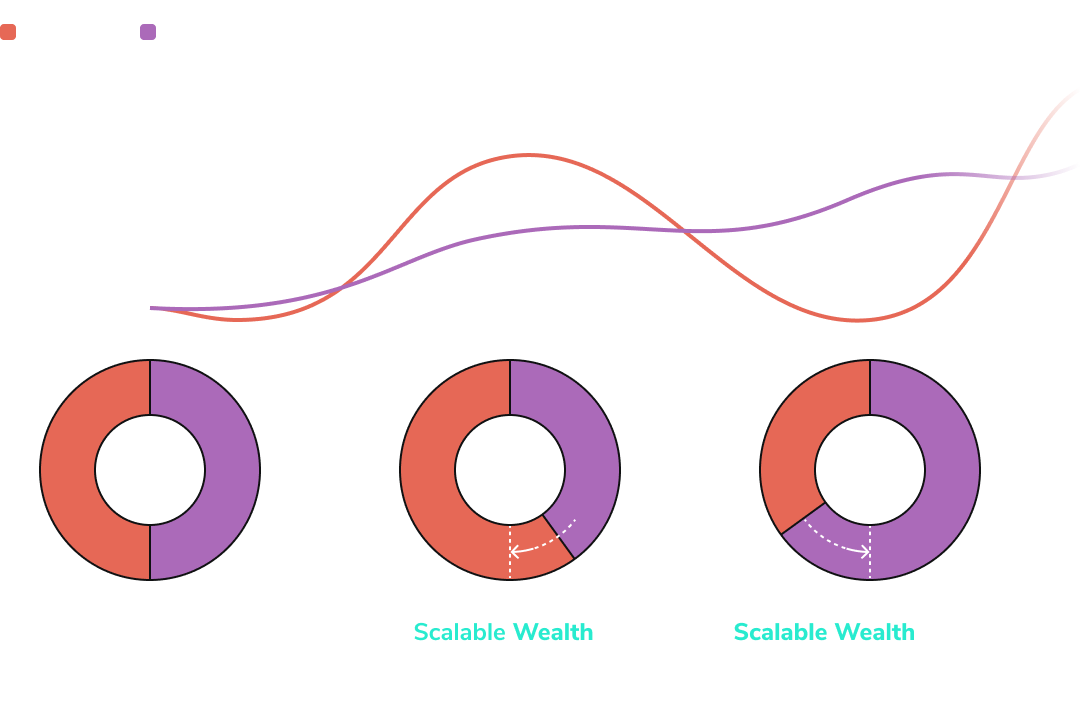

Automatic rebalancing in the event of a deviation from the selected investment profile |

|

Excellent client service |

Scalable Wealth doesn’t just take care of the set up of your investment in accordance with your chosen investment strategy, but also the ongoing monitoring of the portfolio. Our investment technology analyses the weights of individual positions and automatically adjusts them if necessary (Rebalancing) in order to adhere to the target allocation.

Systematic rebalancing can have a positive effect on returns. As rebalancing is generally anti-cyclical, i.e. expensive stocks tend to be sold in good times and cheap stocks are bought in poor times, it is also referred to as a potential "rebalancing bonus".

Anti-cyclical rebalancing keeps the portfolio in balance

|

Join 1+ million people and download the app |